Currency pairs

You know the advantages of trading forex, and you are excited to start trading. Now you need to learn what this market is all about. How does it work? What makes currency pairs move up and down? Most importantly, how can you make money trading forex?

Every successful forex investor begins with a solid foundation of knowledge upon which to build. Let’s start with currency pairs—the building blocks of the forex market—and how you will be using them in your trading.

In this first section, we will explain the following to get you ready to place your first trade

- What a currency pair is

- How you can trade a currency pair

- What happens when you trade a currency pair

Currencies come in pairs

Everything is relative in the forex market. The euro, by itself, is neither strong nor weak. The same holds true for the U.S. dollar. By itself, it is neither strong nor weak. Only when you compare two currencies together can you determine how strong or weak each currency is in relation to the other currency.

For example, the euro could be getting stronger compared to the U.S. dollar. However, the euro could also be getting weaker compared to the British pound at the same time.

Currencies always trade in pairs. You never simply buy the euro or sell the U.S. dollar. You trade them as a pair. If you believe the euro is gaining strength compared to the U.S. dollar, you buy euros and sell U.S. dollars at the same time. If you believe the U.S. dollar is gaining strength compared to the euro, you buy U.S. dollars and sell euros at the same time. You always buy the stronger currency and sell the weaker currency.

Currency pairs are typically divided into the following three major groups:

1. Major currency pairs

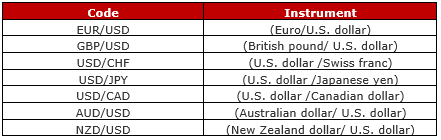

Most forex investors begin by investing in the major currency pairs, or the majors. The majors are those currency pairs that are comprised of the most important currency in the global markets—the U.S. dollar (USD)—crossed with one of seven other globally significant currencies—the euro (EUR), the Great British pound (GBP), the Swiss franc (CHF), the Japanese yen (JPY), the Canadian dollar (CAD), the Australian dollar (AUD) and the New Zealand dollar (NZD).

Take some time to learn the following major currency pairs because you will most likely be using them extensively:

2. Excotic currency pairs

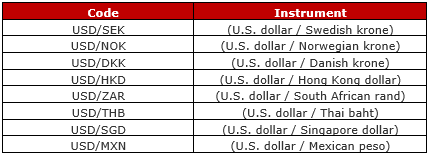

The exotic currency pairs, or the exotics, are the currency pairs that are comprised of the most important currency in the global markets—the U.S. dollar (USD)—crossed with any currency that is not considered a major currency. Exotic currencies—like the Swedish krone (SEK), the South African rand (ZAR), or the Mexican peso (MXN)—are called exotic because they are associated with illiquid currencies that might not be available in a standard trading account.Exotic currencies are usually lightly traded and have large bid/ask spreads. However, many so-called “exotic” currencies are becoming more popular and more and more investors are trading them.

Take a look at the following list of exotic currency pairs because you may be interested in diversifying your forex portfolio with a few uncorrelated currency pairs:

3. Currency crosses

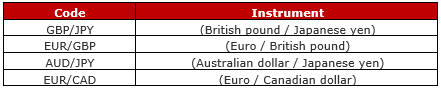

Currency crosses, or the crosses, are the currency pairs that are comprised of any two currencies—so long as neither of them is not the U.S. dollar (USD). The euro (EUR) paired with the British pound (GBP) or the Australian dollar (AUD) paired with the Japanese yen (JPY) would be considered currency crosses.

The following is a list of some of the more popular currency crosses:

Trading currency pairs

By determining what is going to happen to a currency pair in the future, investors can act today to take advantage of coming price movements.

Currency pairs can do one of the following three things:

- They can go up

- They can go down

- They can go sideways

Before you can determine if a currency pair is going to be going up, down or sideways, however, you need to determine which currency in the pair is getting stronger and which currency is getting weaker, compared to the other currency. For instance, if you are looking at the EUR/USD (euro / U.S. dollar) pair, you have to decide if the euro is getting stronger than the U.S. dollar or if the U.S. dollar is getting stronger than the euro.

Note: The first currency listed in the currency pair is called the base currency and the second currency listed in the currency pair is called the quote currency. When you look at the price of a currency pair, it tells you how many of the quote currency it would take to buy one unit of the base currency.

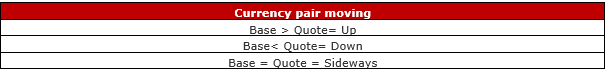

If the base currency is strengthening against the quote currency, the currency pair will be moving up. If the quote currency is strengthening against the base currency, the currency pair will be moving down. If the base currency and the quote currency are equally strong, the currency pair will be moving sideways.

The following is a quick reference to help you remember which way a currency pair will be moving:

Once you have decided which way the currency pair is going to move, you can place your trade.

When trading forex, you can do one of the following three things:

- You can buy the currency pair

- You can sell the currency pair

- You can do nothing

Buying a currency pair (long position)

You can make money trading the forex if you buy a currency pair when the first currency in the currency pair (the base currency) is strengthening compared to the second currency in the currency pair (the quote currency).

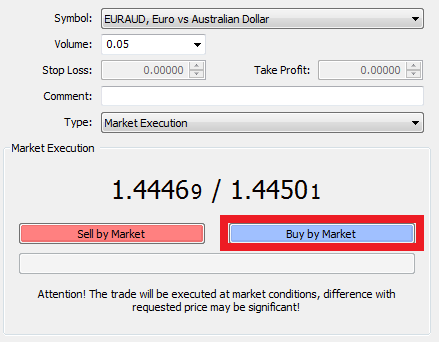

Entering the trade– Buying a currency pair is as simple as clicking the “Buy” button in your trading station.

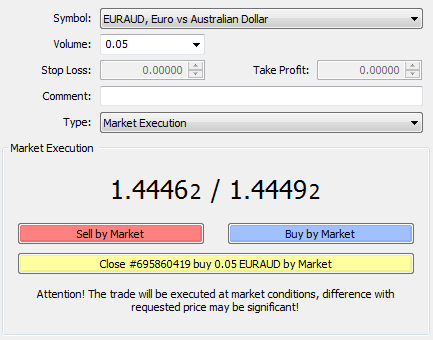

Exiting the trade – Buying a currency pair is only the first step in the trading process. To complete your trade and take your profits, or losses, you have to exit your trade. To exit a trade, you simply have to do the opposite of whatever you did to enter the trade. If you bought a currency pair to enter the trade, you must sell that same currency pair to exit the trade.

Selling a currency pair (short position)

You can make money trading the forex if you sell a currency pair when the second currency in the currency pair (the quote currency) is strengthening compared to the first currency in the currency pair (the base currency).

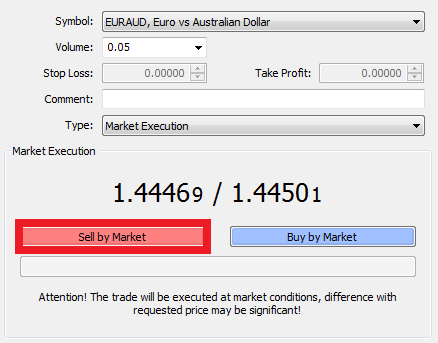

Entering the trade – Selling a currency pair is as simple as clicking the “Sell” button in your trading station.

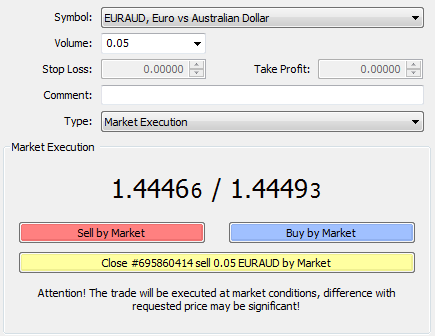

Exiting the trade – Selling a currency pair is only the first step in the trading process. To complete your trade and take your profits, or losses, you have to exit your trade. To exit a trade, you simply have to do the opposite of whatever you did to enter the trade. If you sold a currency pair to enter the trade, you must buy back that same currency pair to exit the trade.

The mechanics of trading currency pairs

The forex market shares many similarities with other markets you are acquainted with in your life—like the super market or a car market—where you can buy and sell items for a set value. However, you also enjoy a few unique benefits when you invest in the forex market. For instance, when you trade in the forex market with BenchMark MetaTrader , you are able to control and profit from significant quantities of currency without having to pay for it all up front yourself.

Leverage

Leverage is probably the one characteristic of the forex market that intrigues individual investors the most. Leverage is the ability to convert a small amount of power into a larger amount through the use of a tool. Imagine you are asked to move a large boulder from the spot where it is currently resting. You could certainly try to push and move the boulder with your bare hands, but your job will be much easier if you can use a tool—like a large pole—that you can place under the boulder that will give you some leverage.

The same principle holds true when you are investing in the forex market. You can make money by investing just your own money, but you can make much more money if you can use the tool of financial leverage by borrowing money from your dealer.

You can lever, or increase the investing power of, your forex accounts by using some of your own money to enter a trade and then borrowing the rest from your dealer. For example, the forex market allows you to control $100,000 with as little as $1,000 of your own money. That means you only have to pay for 1 percent of the position with your own money. You can borrow the remaining 99 percent of the purchase price from your dealer. The leverage you enjoy in the forex market is determined by the margin you are required to post for each trade.

Margin

The forex market is an exciting market because your dealer is willing to lend you money so you increase your profit-generating potential in all of your trades. Before your dealer lets you borrow money, however, you have to show that you have some money to cover any losses you may incur. Margin is the money you set aside with your dealer for safe keeping to prove that you are able to cover your losses.

For example, if you buy the EUR/USD, you will be required to set aside 1 percent of the position size as margin. That means if the position size is 100,000 euros, you will be required to set aside the equivalent of 1,000 euros to prove to your dealer that you can cover losses of at least 1,000 euros should your trade move against you.

Different currency pairs have different margin requirements. Major currency pairs have lower margin requirements because their high levels of liquidity make it easier to enter and exit your trades quickly—which gives your dealer added confidence it will be able to close out your 9 positions without incurring unexpected losses. Exotic currency pairs have higher margin requirements because their low levels of liquidity make it harder to enter and exit your trades quickly.

Many beginning forex traders get confused by thinking that the money they set aside as margin actually goes toward purchasing currencies. It does not. You borrow 100 percent of the purchase price from your dealer. Your margin only shows your dealer you have money to cover any lossesthat you may incur.

When you buy a currency pair, you do not have to come up with the cash on your own. Your broker loans you enough of one currency to buy enough of the other currency in the pair. For example, if you click on the “Buy” button to buy the EUR/USD pair at 100,000 units, your dealer will loan you enough U.S. dollars (USD) to buy 100,000 euros (EUR). If the EUR/USD exchange rate is 1.4000 at the time, your dealer will loan you 140,000 U.S. dollars to buy 100,000 euros.

Example of margin amount calculation:

Imagine that you have a certain amount in euro in your trading account and want to buy the currency pair EURJPY. For this example, make the following calculations:

At the moment, the currency pair EURJPY is trading at 137.13, which means that 137.13 Japanese yen (JPY) can buy 1 euro (EUR). Imagine that the size of your position is 100,000 euro (EUR).In order to determine the amount of margin with which you will participate, you can take the following steps:

Determine how many Japanese yen (JPY) you must borrow from your broker to secure 100,000 euro (EUR).

€100 000 х 137.13 = ¥13 713 000

Determine how many Japanese yen (JPY) you will need to cover the required margin amount with leverage, for example, 1:100.

¥13 713 000 х 1% = ¥137 130

Determine how much euro (EUR) is required to participate as a margin amount to cover ¥ 137 130.

¥137 130 / 137.13 = €1 000

The spread

The spread is the distance between the price at which you can buy a currency pair and the price at which you can sell a currency pair at any given moment.

You cannot buy a currency pair and immediately turn around and sell it at a lower price. The price at which you can buy a currency pair (the “Ask” price), is always higher than the price at which you can sell a currency pair (the “Bid” price).

Whenever you enter a trade, you start out with a small loss because of the spread. You must overcome the spread—hold onto the trade long enough for it to move through the spread—before you will be profitable on your trade. It is a small hurdle to clear and a small price to pay for the leverage and liquidity BenchMark provides in the forex market.